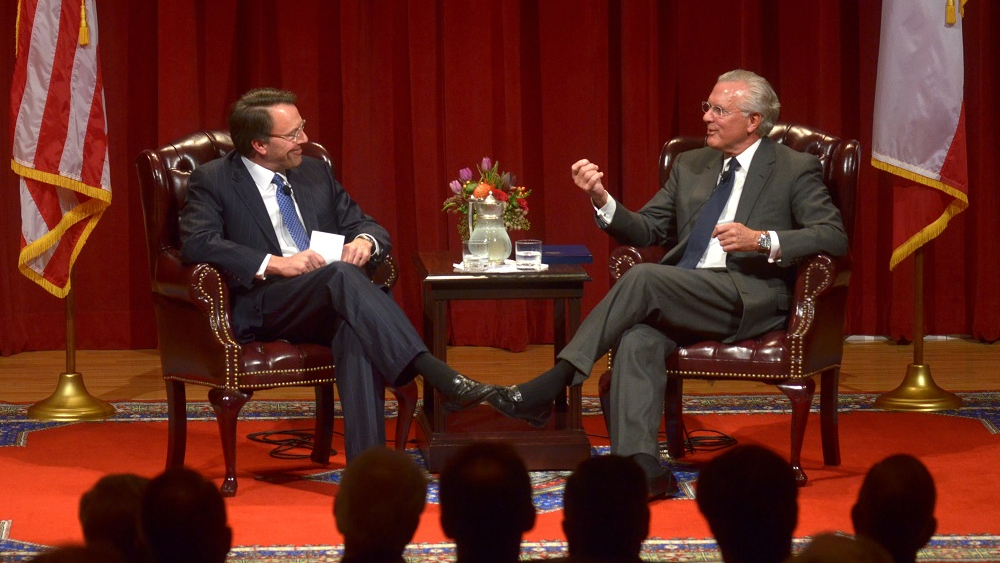

At the Mosbacher Institute’s inaugural Conversations in Public Policy event, Ambassador Richard Fisher, the President and CEO of the Federal Reserve Bank of Dallas from 2005 to 2015, and Mr. Robert Mosbacher, Jr., the Chairman of Mosbacher Energy Company, reflected on how intertwined the United States’ monetary policy is with global financial markets. Ambassador Fisher, and Mr. Mosbacher discussed global trade and the ways countries can keep themselves economically prosperous.

The Mosbacher Institute for Trade, Economics, and Public Policy at the Bush School of Government and Public Service hosted the event at the Annenberg Presidential Conference Center. It began with welcome remarks from Ambassador Ryan Crocker, dean of the Bush School, and introductions by Dr. Lori L. Taylor, director of the Mosbacher Institute.

Ambassador Fisher delivered remarks reflecting on his experience at the Federal Reserve of Dallas which serves approximately 28 million citizens. A large portion of Fisher’s remarks focused on the reality of a “global world” which has tied United States’ monetary policy with the global financial markets. “Moving forward the United States would do well,” Fisher said, “to seek stability so entrepreneurs as well as small and medium businesses are able to create the jobs that drive a strong economy.” Fisher remarked that making predictions about the economy is similar to predicting weather patterns years in advance. Thus, while it is impossible to know what the faults in monetary policy are, we can focus on creating an economic climate which encourages job creation and stability.

After Ambassador Fisher concluded his remarks, Mr. Mosbacher initiated a conversation with Ambassador Fisher. One particularly interesting exchange concerned the current political climate for trade agreements. Assuming a “good” trade agreement was proposed, Mosbacher asked, what could be done to obtain bipartisan support within the polarized legislature? Fisher responded that strong leadership must be the driving factor, citing President H.W. Bush and his Secretary of Commerce, Robert Mosbacher, Sr., as well as President Clinton, as examples of the kind of leadership the United States needs to make successful trade agreements. Mosbacher pointed out the correlation between decreased trade barriers and more robust and inclusive economic growth, and that politicians would have to take a political risk to support trade.

The conversation next turned to China. Fisher said that despite their large economy and vast production, the system is not efficient and is unlikely to be truly threatening to the United States because the Chinese government is a “control freak” too willing to “contain the animal spirit” of commerce. Thus, their economy will continue to be substantial, but neither innovative nor efficient. Fisher went on to explain the best way to deal with uncertainty is to implement laws, be open to structural change, have a legislature who is willing to make tough choices, and permit competition. The solution he concluded is most certainly not to print more money.